26.08.2019

Posted by admin

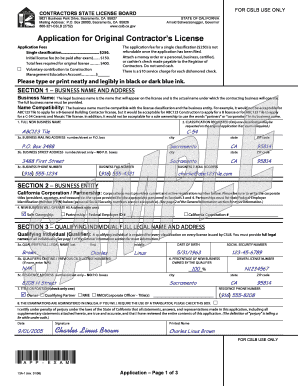

The application fee for a single classification ($300.) is not refundable once the application has been filed. Attach a money order or a personal, business, certified, or cashier’s check made payable to the Registrar of Contractors. Do not send cash. There is a $10 service charge for each dishonored check. The hiring paperwork for independent contractors is much simpler than for employees, with only a few documents needed, but these are important documents. Getting them at the beginning of the working relationship is a lot easier than when the job or contract is done, and you can't find the person.

Show sufficient base period earnings. To determine whether you’re eligible for SDI benefits, and how much you’ll receive, the EDD looks at your income during the year-long period beginning between 15 and 17 months before the date of your application.[10]

Show sufficient base period earnings. To determine whether you’re eligible for SDI benefits, and how much you’ll receive, the EDD looks at your income during the year-long period beginning between 15 and 17 months before the date of your application.[10]Sample Applications To Fill Out

- The EDD will divide your 12-month base period into three-month quarters. To be eligible for SDI you must have earned at least $300 during one of those quarters. The quarter in which you made the most money is the quarter the EDD will use to calculate your benefits.[11]

- If you were unemployed during any of those quarters, the EDD will disregard that quarter and start your base period a quarter earlier. For each unemployed quarter, the base period continues to start earlier until it covers a period in which you were employed.[12]

- For example, suppose you file your application in April. Your base period would be the 12-month period ending December 31 of the previous year.[13] Last year would then be divided into three-month quarters, and the quarter in which you earned the most money would determine your benefits.

- Continuing the example, assume that from January through April of last year, you worked full time and made $1,100 a month. In May you were laid off, but found part time work in June making $500 a month. You continued that job until October, when you found more full-time work earning $1,500 a month. Since you made the most money in the final quarter of your base period, that would be the amount the EDD would use to calculate the amount of benefits you are eligible for each week.

- The total amount you earned during your base period also determines how long you’ll receive benefits and how much you’ll be paid each week.[14]